In recent years, social media has provided a vibrant platform for Nigerians to showcase their talents and earn big even in foreign currencies. However, unlike what obtains in other countries, content creators and influencers barely pay tax from the fortunes they make in the digital space owing to what experts identify as lapses in Nigeria’s tax laws.

The tax record of Ibrahim Ajibade, a clerk at a consulting firm in Lagos and that of an average Nigerian social media content creator, presents a stark twist of irony. Ajibade, like every civil servant in Nigeria, pays tax from his N70,530 gross earning every month.

In contrast, skit makers, YouTubers, TikTokers and influencers manage to evade tax despite earning bigger. Yet, they access – at little or no costs – infrastructural facilities such as roads and hospitals constructed with funds raised from taxes paid by poor salary earners like Ajibade and others.

As the government grapples with dwindling revenues and mounting public debts hovering above N87 trillion, these entertainers lead an income tax-free, luxury lifestyle, building mansions in choice areas and riding expensive vehicles.

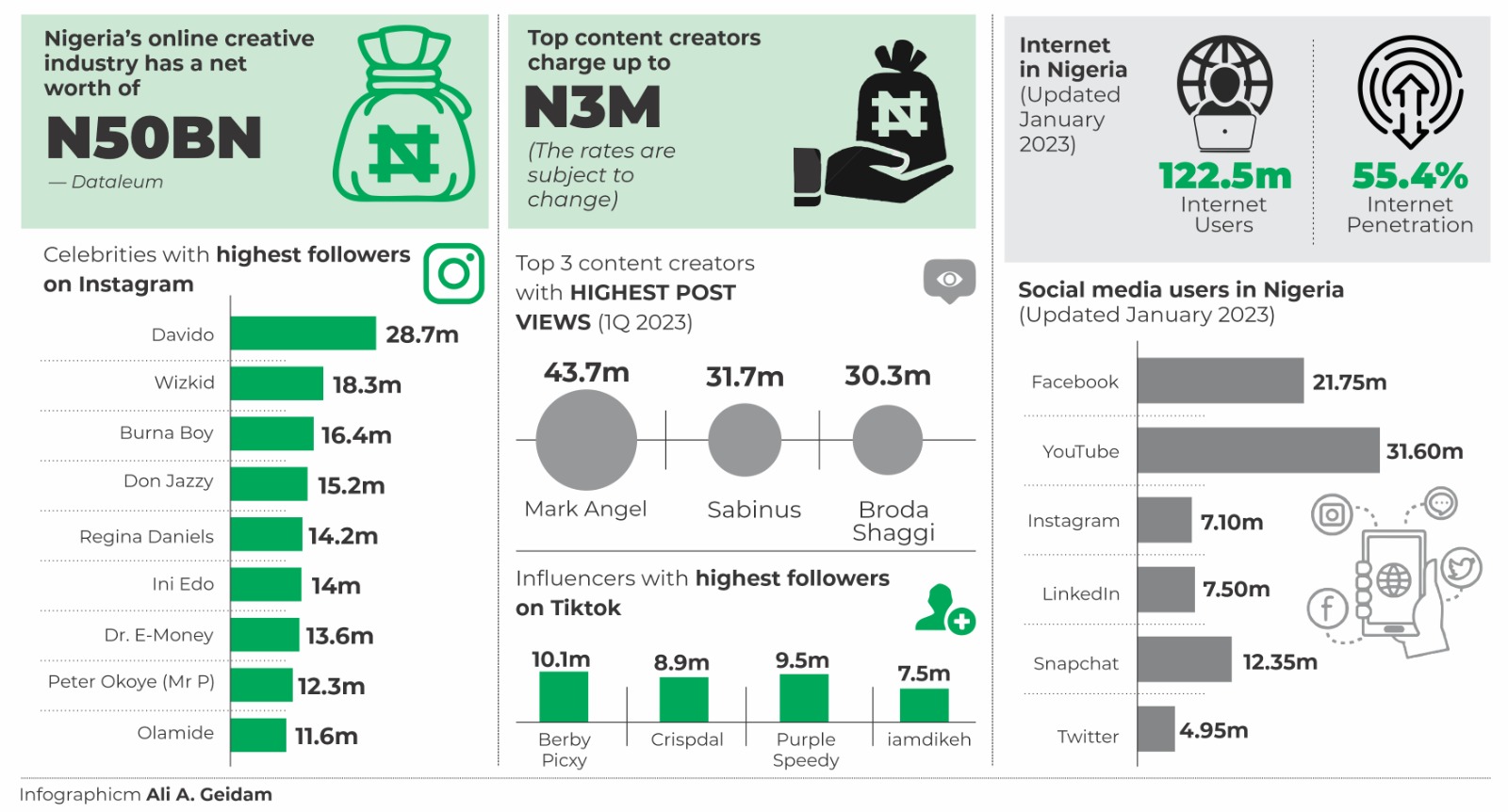

The online creative industry is a goldmine with skit making alone ranked by Dataleum “as the third largest entertainment industry in Nigeria with a net worth of over N50 billion”.

Nigeria boasts of a population estimated at over 200 million and high social media users, thereby providing a huge local market for content creators and influencers, aside from the global reach.

A report by DataReportal revealed that in January 2023, Nigeria’s internet users were 122.5 million, even though the internet penetration in the country stood at 55.4 per cent – meaning that 98.63 million people did not use the internet at the time.