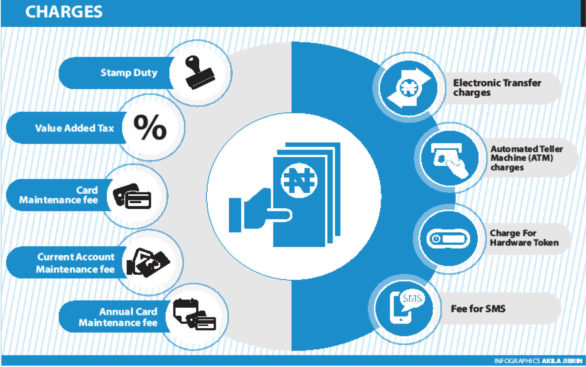

Customers of different commercial banks are groaning over excessive charges from their accounts, findings by the Daily Trust revealed.

The financial institutions known as Deposit Money Banks (DMBs) in corporate parlance have reportedly introduced different deductions to increase their incomes, a development that did not go down well with customers.

While some customers reluctantly accept stamp duty deduction, others spoken to said that additional charges for maintaining a bank account were unbearable.

A recent attempt by one of the commercial banks to recover three months of stamp duty from its customers sparked an outrage, which eventually forced the bank to jettison the effort and reverse the deductions already made.

Apart from stamp duty, bank customers also pay Value Added Tax (VAT) charges applicable to all vatable transactions in their accounts. The VAT rate stands at 7.5 percent in compliance with the Finance Act.”